3 High Cost Traps To Avoid While Investing

It is great to see the financial smartness movement pick up steam, especially since the last month. In the previous articles (1 and 2), we talked about how a systematic goal-based approach helps a woman take charge of finances. Putting such a system in place resolves the paradox in the lives of women - working hard both in their careers and at home, but still taking a backseat in financial matters.

While this is good stuff, it is important to be mindful of avoiding costs involved that could delay your financial goals by years, if not decades. Most of us get blind sighted by such numbers - investing is supposed to increase our corpus, so a small fee or commission is easy to miss, especially when pushed by aggressive salespeople.

#1. The Costly Impact Of Taxes

Someone once said that in life, three things are not avoidable - disease, death and taxes! While one cannot avoid taxes, it makes sense to invest in instruments that optimize tax. Some tips are:

-

Invest the maximum possible in government schemes that give tax benefit under Section 80C under the EEE category: Exempt at time of investment, interest and redemption.

-

Avoid schemes like National Saving Schemes whose gains are taxed upon redemption.

-

When investing in Mutual Funds or Equities, be aware of Dividend Distribution Tax. Based on your tax bracket and invested asset, choose your investment mode wisely.

-

For someone in the 30%+ tax bracket (earning above 10 lakhs p.a.) a dividend scheme in debt funds might help as it is taxed lesser.

-

Equity funds have a DDT of 10% which is unavoidable. Here, growth schemes are better.

-

Choose a dividend scheme only if you have a need for liquidity (i.e. income is not sufficient to meet expenses).

-

It is important to mention Long Term Capital Gains (LTCG) announcement in the recent budget. A tax of 10% on long-term gains (with an exemption on the first one lakh) does not impact a vast majority of investors. A Rs one lakh gain, assuming historical 10% return, means a corpus of Rs 10 lakhs in equities. The average retail equity folio size as per AMFI is just about Rs 80,000! The message here is - keep investing for the long term, don’t worry about unavoidable taxes too much

#2. The Drain Of Commissions

Commissions cause perhaps the biggest erosion of wealth for investors. Brokers take hidden commissions of 1% to 1.5% on equity mutual funds. This adds up to about 40% over time.

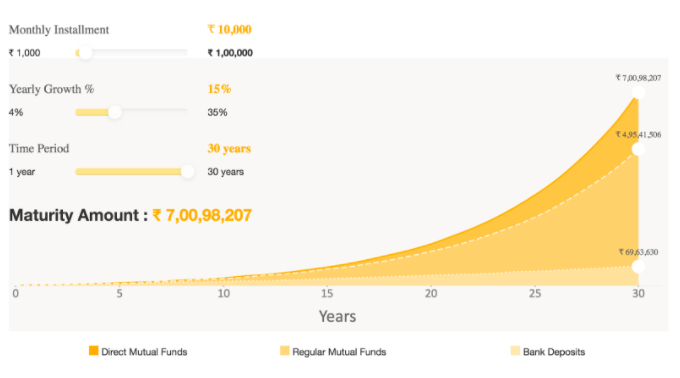

To illustrate this better, let us take an example: Richa puts in SIP of Rs 10,000 per month into an equity mutual fund in the 'Direct Plan'. She ends up with Rs 7 crore, as compared to Sunita who invests in the 'Regular Plan' and ends up with 4.95 crores.

So Richa makes 40% more than Sunita in the long term.

The solution, clearly, is to invest only in mutual funds schemes that have the word 'Direct Plan' in them. If you have invested in regular plan investments, then it is easy to switch them to direct.

#3. The Cost Of Brokerages

For the adventurous lot investing in direct stocks, please do check if you are paying high brokerage on every transaction. Some brokerage charges are more than 0.5% per transaction. Which means that if you buy Rs 1 lakh and sell it after some time to book a profit (or loss), the brokerage will be Rs 1,000 on your money. That is a lot, and over time it eats away your corpus (as we saw in the above illustration).

For the majority of investors who do not have the risk appetite or time/energy to invest in stocks, Mutual Funds are a better vehicle. And the good thing is that you don’t need a demat account for investing in them. This alone saves you a few thousand rupees of long term cost!

In conclusion, costs can eat away a significant portion of your wealth, please be aware of the taxes, commissions and other fees involved in all your investments. Avoid them “at all costs” to ensure that you reach your financial goals well in time!

This article is part of a series on financial planning for women. You can read the previous articles here and here.

This advisory piece is written by Ram Kalyan Medury, a Fintech Enthusiast and Entrepreneur. He founded Jama, an online & mobile app based direct mutual fund platform and investment advisory. He has nearly two decades of Fintech experience at leading companies like Infosys, ICICI, Magma. As an entrepreneur, he is passionate about spreading investor awareness and helping people create wealth by investing in high return, low-cost instruments. Ram is a SEBI Registered Investment Advisor and an MBA from IIM Bangalore.