I agonised over writing for years – Do I know enough to be able to write? Ok, I know stuff about money but can I write well? Why would anyone want to read my book or blog? Only after a lot of encouragement from friends, one day I just started writing. I am sure that the more I write, the better I will get.

This is how I started my first post on Women's Day last year. I did get better. In fact, I became one of the 10 LinkedIn Top Voices on Money and Finance for 2015. So I am re-posting this blog, with a changed title and a more solid solution.

My less-than-complete confidence in writing is what happens to women and investing. Women are not confident about investing. Research shows that women don’t make investment decisions the same way as men do. They tend to take less risk. And men rush in where women fear to tread.

Women trade less

In a 2001 study, titled Boys will be boys (yes, some academics have a sense of humour), the authors looked at the trading pattern of retail clients of a large brokerage house in the US over a number of years. They found that retail investors tend to make the worst mistakes – getting into the market or individual stocks after they have gone up and getting out after they have gone down. The more they traded, the more money they lost. But here’s the punch line - men traded more often, and hence, lost more. Women were less confident, traded less often and hence, didn’t lose as much. (Both lost money because of excessive trading but we will discuss that another time).

Women are less confident about investing

More recent research suggests that the lack of confidence might be more related to the lack of knowledge rather than gender. A Merrill Lynch study released in 2014 showed that women were far more likely than men to say they know less than the average investor about financial markets and investing.

But how much they think they know is different to how much they actually know. It’s possible women actually know less than men about investing, or they know as much as men but just have less confidence in their knowledge. Either way, it would help if they built their knowledge or could compare their knowledge with some standards so they felt more confident.

Yet, women need financial literacy more

The low level of financial literacy in women is a concern. The reality is that women take time out of the workforce when they bear and raise children. This means no savings during this time – personal or in pension plans. The compounding effect means these few years make a significant difference.

As has been reported widely, when they do work, women tend to get paid less because they don’t negotiate as hard as men. All of these lead to more financial stress, in case the marriage breaks. And yet, they live longer, so are likely to need more in retirement.

But do women want to engage more with money? That’s another question. A lot of women roll their eyes at the mere mention of money and investing. It’s boring!

Or so the men would have us believe. Maybe not intentionally, but is it possible that the reason women are not as engaged as they should be is because of the way the communication is designed?

The Men are from Mars, Women are from Venus paradigm suggests that men and women process information differently. It’s possible they would prefer information presented to them in a different way. Their knowledge starting point might be different. Would there be any harm in customising some investor education initiatives to women?

Personally, I think not.

I don’t mean the communication needs to be laced with pink or flowers, but perhaps less intimidating, more approachable. Maybe more right-brain, visual and story-telling compared to the dry, number and jargon-ridden communication the finance industry sends out today.

I am happy to lead by example.

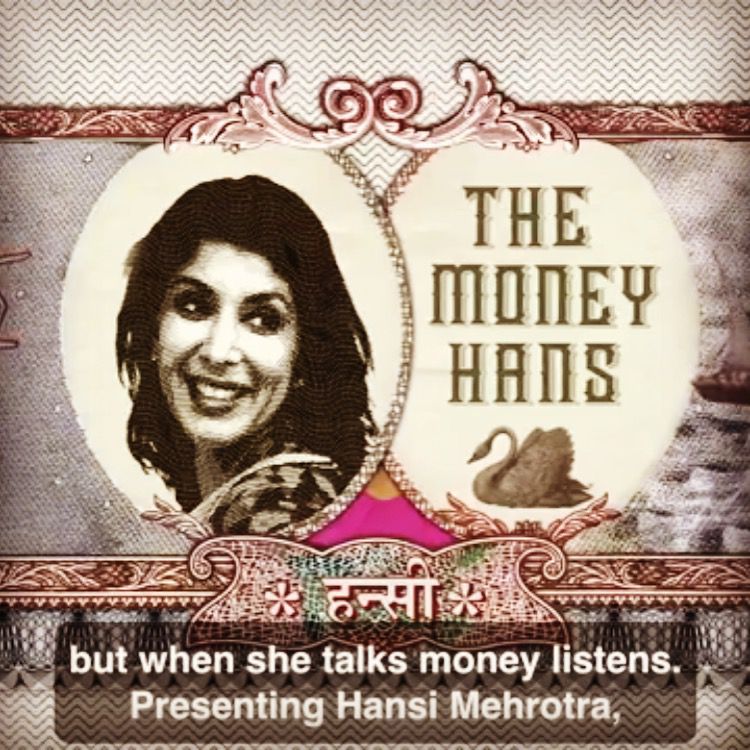

On this Women's Day 2015, I am starting to write this blog. The intention is for this blog to become a collection of simply written, non-technical posts on money matters, written by a woman for women. Yes, there are many such columns by well-meaning journalists – consider this one with an industry insider’s point of view. I hope I can put my two decades’ experience in the financial services industry to help women take an interest and get more confident about money.

I have now taken this initiative a step further and partnered with BigDecisions to bring out a video series to talk about money in a fun and engaging way. 'Money Talks With Hansi' will be a series of 5 minute videos based on these posts on YouTube.

I have 20+yrs experience in the finance industry across Asia Pacific. I now share my learnings at TheMoneyHans.com, a financial literacy blog to help beginners learn about money.

Join your favorite communities! Learn everyday from each other.

Meet new friends. Connect with women as awesome as you.

Use Helpline to chat privately with our professional counsellors for FREE.

Email login is only for existing users. New users should login via Facebook or Google only.

SHEROES is a women only platform. Facebook says you are a Gentleman

To reactivate your account write to us

care@sheroes.in