Must Haves in a Portfolio

An investment in knowledge gives the best interest. Before investing it is important to understand few concepts of investing. And pondering over some key points that affect all our investments.

Are we taking sufficient precautions against inflation? Is our money compounding and lastly is it subject to the risk and the return we want. Let’s understand each of these concepts and the implications on our investments.

Inflation: The increase in prices of goods and services is inflation. Inflation reduces our purchasing power. It is critical that the return we make on our investments beats inflation. However we need to keep in mind risk and diversification. E.g. Equity investments in the long term beat inflation, however the risk is high in this asset class and we must not invest all our monies only in equity. Overall the return from our investments must beat inflation post tax.

Compounding – This is the eighth wonder of the world. All investments made before the age of 60 should be a compounded option. As seen from the below mentioned table over a long term period compounding leads to higher growth in monies invested.

Power of Compounding Rs 100000 @8%pa

| Duartion | Simple | Compound |

| 3 years | 124,000 | 125,971 |

| 5 years | 140,000 | 146,933 |

| 10 years | 180,000 | 215,892 |

| 20 years | 260,000 | 466,096 |

Risk- is the amount of money that can be exposed to an unsafe instrument where you can loose money. The Three key components of an individual risk profile are:

Ability to take risk, Willingness to take risk, Need to take risk. One must understand how much of risk ones investments are exposed to.

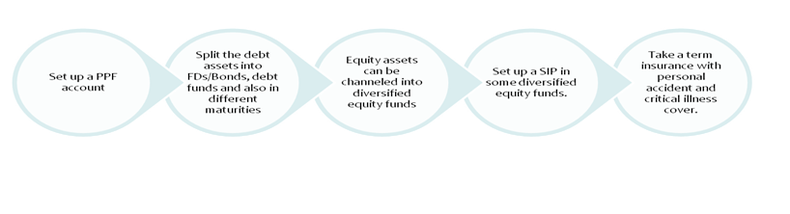

Keeping Inflation, Compounding and Risk in mind in order to have a balanced portfolio there are few MUST HAVE PRODUCTS in ones portfolio.

Womantra Must Haves in a Portfolio:

PPF A/c – Public Provident Fund Account probably the only product which beats inflation, compounds, risk free and tax free. This product should be a part of every individual portfolio. Excellent way to build a corpus for retirement or for your child education.

Debt Instrument of Different Maturities- Debt MUST BE an integral part on ones portfolio. It gives stability of returns to the portfolio. It not only important to plan for the long term but also to manage short term funds efficiently. Any monies which are needed within 6tms may be kept in a FD or liquid funds. Monies with an investment horizon of 1-2 years in short term funds and monies with 2-5 years in long term debt funds.

Diversified Equity Funds- Equity as an asset class makes sure that your investments beat inflation by the highest margin compared to other asset classes. However there is a risk attached to this category hence it is critical to have in a portfolio but stick to diversified large cap equity funds.

SIP – Systematic investment plan is a method of investing in mutual funds. It is similar to a recurring deposit concept where every month monies are invested automatically in a fund selected by you. A SIP is a must have because it beats inflation works on compounding, diversifies risk and gives tax free returns. Illustrated below shows how a simple invest multiplies over a period of time.

| Amount | Rs 9000 pm at 9%interest |

| Duration | Maturity |

| 10 years | 19,35,142 |

| 15 years | 37, 84,057 |

Term Insurance – Most often we don’t plan on the amount of insurance we take. One MUST have a pure term plan cover (value is approximately 7x annual expenses). We often take endowment plans, ulips etc but forget that the main aim of insurance is to cover the risk of death and help the family survive through the years once the income from the contributing member stops. A pure term cover with accidental and critical illness riders is mandatory.

Womantra TIP

Invest in Simple Products

Mrin Agarwal & Rima H - Founders and Trainer, Womantra (Womantraining@yahoo.com) | Womantra Facebook Page